gst cash payout 2022

Online DSA Loan Agent Registration benefits DSA Loan agent registration online program available for Pan India locations opportunity to earn highest payout 100 digital process available wide range of financial products with loans and credit cards insurance products mutual funds and many more services available for sourcing for DSA loan agents at DOL Partner. And the GST Voucher Cash will be disbursed in August 2021.

Healthcare subsidies GST voucher that the Government has put in place in recent years to give seniors greater assurance in retirement.

. Total Value of Supplies 100000. The GST Council chaired by Finance Minister Nirmala Sitharaman will meet on December 31 and discuss among other things report of the panel of state ministers on rate rationalisation. Benefits for GST-registered companies announced in the Budget 2015.

The equivalent cash amount will be credited to your credit card account within 7 working days. CBIC to withdraw 12 GST rate 1 January 2022 onwards. The GST Voucher Cash Special Payment will be disbursed in June 2021.

For new GST-registered companies this years Budget has announced that companies that apply for GST registration on or after 1 July 2015 can look forward to a simplified process when claiming GST incurred up to six months before the date of registration. Governor Tamilisai Soundararajan has sanctioned 117 crore as salary payout for Puducherry Road Transport Corporation PRTC staff for the 2021-22 period. Standard call charges apply Please call PAYBACK on 1860-258-5000 or place an online request for redemption at wwwpaybackin.

It provides a quarterly cash supplement to seniors who had low incomes during their working years and now have less in retirement. In its GST F5 for the accounting period ended 31 Dec 2019 Company A has omitted a standard-rated supply 10000 GST 700 and a taxable purchase 1000 GST 70. Taking twice of the second cash payout would be equivalent to 1-month contracted gross rent as indicated in the stamped lease agreement for the.

The Central Board of Indirect Taxes and Customs CBIC has notified that 18 Goods and Services Tax GST rate will be applicable 1 J 1 January 2022 onwards and f the 12 GST rate for government contracts will be withdrawn. This means that even if the value of the assets in the trust increases beyond the exemption limit you will not have to pay the generation-skipping transfer tax. The Tax Cuts and Jobs Act signed into law in 2017 doubled the estate tax exemption until 2026.

If you want to make sure that you get your money ASAP youll need to set up your PayNow and get it linked to your NRIC. The Silver Support SS Scheme is part of a wider suite of schemes eg. The third cash payout will be distributed automatically to all recipients of the second cash payout to ensure that eligible tenants and owner-occupiers receive their payout as quickly as possible.

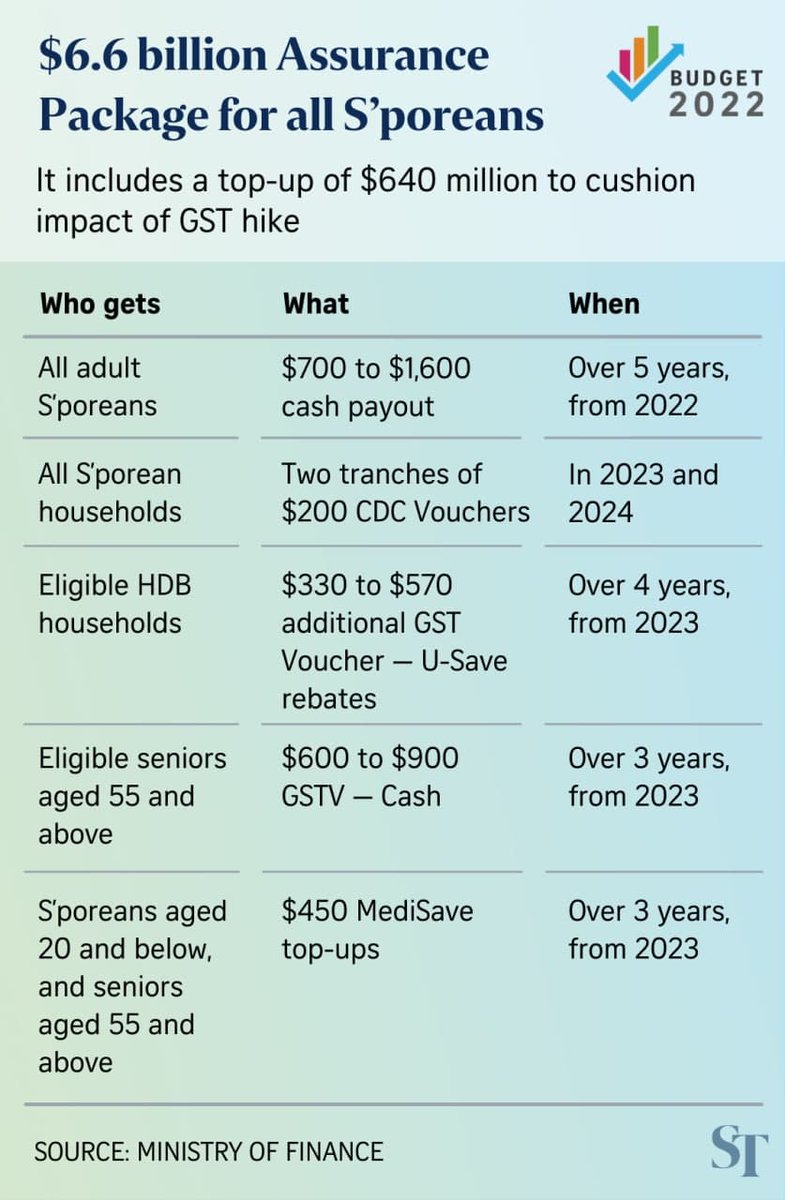

Budget 2022 S Poreans Aged 21 And Above To Get S 700 To S 1 600 Cash Payout Over Next 5 Years News Wwc

Comments

Post a Comment